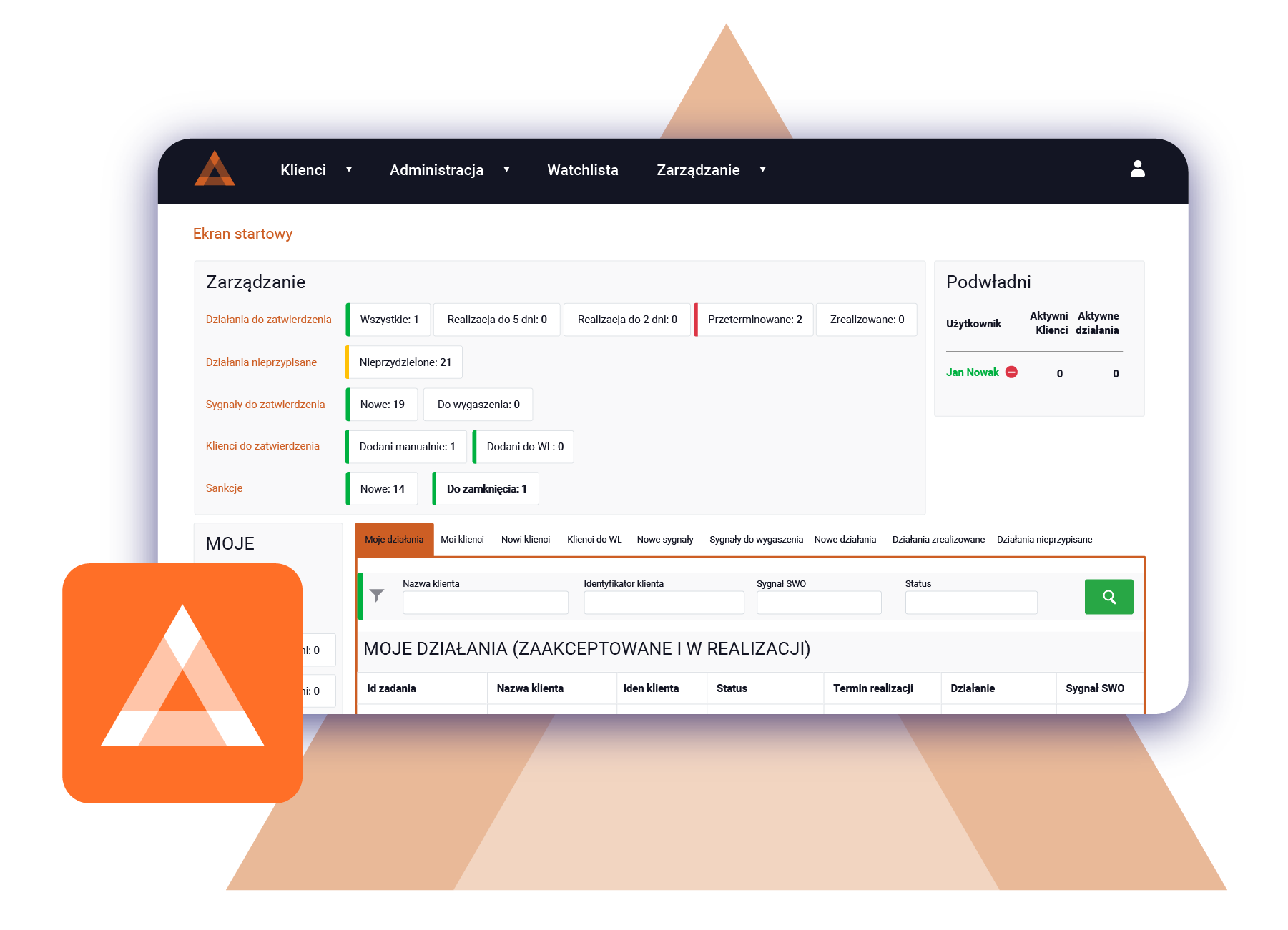

VSoft Early Warning System - Effective client monitoring

Advantages of using the VSoft Early Warning System

Automatic monitoring of clients’ financial health

Analyzing data from various sources

Rapid response to threats

Fully implemented on the archITekt low-code platform

VSoft Early Warning System supports institutions in the automatic verification and continuous monitoring of their clents’ financial health.

The system enables rapid identification of warning signals indicating a deterioration in a client’s financial situation. Upon detecting a potential threat, it automatically initiates appropriate corrective actions, assigns them to the responsible staff, and supervises the implementation process.

In cases where the probability of financial recovery is low, the system effectively supports strategic business decision-making focused on minimizing potential losses and protecting the institution’s interests

tailored to your business needs.

Product Features

Monitored Entities Database

The solution adjusts the scope of stored data to the type of monitored entity (e.g. sole proprietorship, joint-stock company, individual). The data scope can be configured using the VSoft archITekt platform.

Warning Signals

In addition to predefined signal implementations, users can graphically model any calculation algorithms. By using both current and historical data, along with change tracking, users can design and calibrate signals to realistically reflect risks or opportunities.

Automatic Data Acquisition

The solution enables automatic data retrieval from: CRM systems, financial data warehouses, external systems (e.g. KRS, BIK, BIG). The primary source of data is the institution’s internal databases, systems, and available APIs. The solution offers an open communication mechanism that enables easy integration and data utilization within the system.

Data Feed Mechanism

Responsible for automatically supplying the system with data. The solution supports scheduled automatic data retrieval as well as manual, on-demand updates initiated by users.

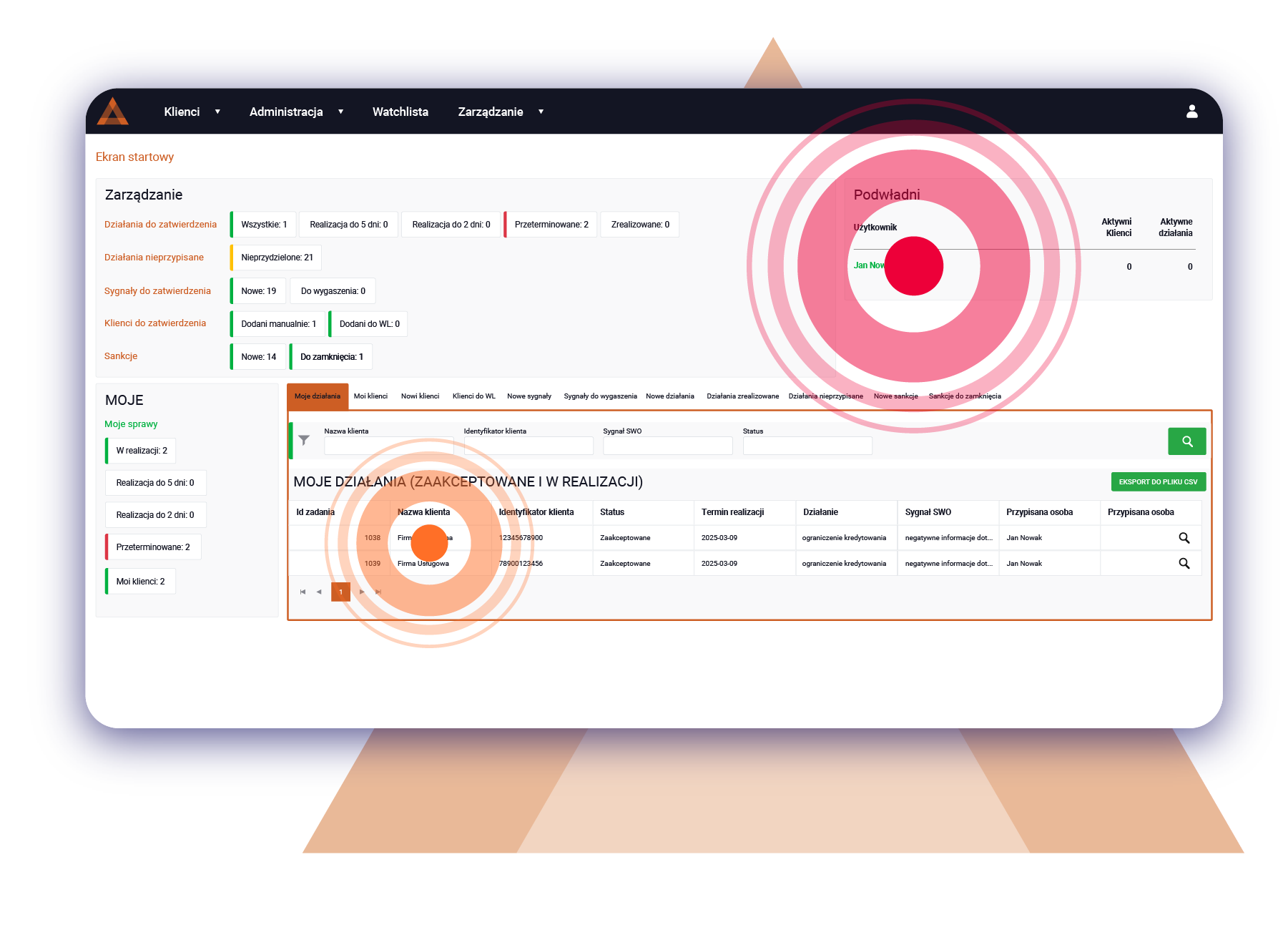

Administration Panel

The interface allows users to configure and operate the system. The range of available functions depends on the user’s access rights.

Operational Activities

Enable rapid responses to individual or correlated signals within a defined time frame. Actions may be generated automatically or added manually by the user. Each action is assigned to a specific user or group and may require approval from a decision-maker.

Business Decisions

Based on the generated signals and completed operational activities, the system allows documentation of business decisions.

Monitoring

If there are delays in task execution, the system automatically sends reminders and escalations, supporting effective process management.

Workflow

Benefits

01

Automation of the client financial health monitoring process.

02

Early detection of financial issues enables the development of effective remedial actions.

03

Rapid identification of high-risk clients allows for the implementation of measures to reduce potential financial losses.

04

Automated data analysis makes it possible to monitor a significantly larger number of clients without increasing operational resources.

05

Improved team efficiency through automated task management and monitoring of task completion.

06

The VSoft archITekt low-code platform allows users to independently define signals, data sources, and operational actions.

VSoft Early Warning System najczęściej jest stosowany w organizacjach takich jak:

Banki

Firmy leasingowe

Firmy faktoringowe

Firmy ubezpieczeniowe

Additional materials

Article

VSoft e-court collection - what if we automated the communication between the debt collection system and e-court?

Automating communication with the Electronic Case File (EPU) minimizes office-related tasks in the traditional sense (handling documents, correspondence) in cases handled in e-Court. Do you want to know how? Read the article!

Article

Choosing a debt collection system - a universal product or a tailor-made solution?

Choosing a system can be a commitment for years, and it is essential to choose one that will allow our organization to grow and quickly adapt to changes in our environment. We present 4 crucial steps that will help you choose the right IT solution.

Article

Technological trends in debt collection

Technological trends in debt collection mainly involve increasing automation and robotization of activities that were previously performed by humans. Modern tools such as AI, scoring, and data analysis not only streamline debt collection processes but also translate into the efficiency of the company.

Article

Electrifying the digitalization of debt collection processes

Automation of debt collection processes is entering a new level, thanks to the rapidly advancing digitalization of services provided by debt collection companies, as well as wider access to data in public services. What data is this and how can it be obtained? Read the article to find out

Write to us

Interested in learning more about VSoft Early Warning System?

We’d be delighted to introduce you to the full potential of the System.

Complete the form and we will contact you and present an offer.