Insurance Product Management

In our last blog post, we wrote about the API, sales processes and the Insurance System, which can be a product engine for other systems. We would like to elaborate on the latter, related to the product engine, focusing on insurance product management. We will start by defining what an insurance product is.

Expand insurance market: How to transform an insurance multi-agency into an industry leader?

In today's digital age, the applications we use every day process huge amounts of data, providing us with the data we need at any given moment. Regardless of how and where this information comes from, our main focus is on its effect - the fact that it is available. End-user expectations focus on ergonomic use of applications, ease of access to relevant information, speed of operation and an attractive design. Building a suitable graphical interface that is used by many users is undoubtedly an interesting challenge. However, it is more important to construct it in such a way that it provides the right information to the user, and in a way that allows our solution to be fully integrated with other systems.

Sales of insurance as well as motor and property products by leasing companies

Leasing companies are increasingly offering insurance products. In order to keep up with the growing demands of customers, insurance departments, including those at leasing companies, are seeking new and innovative solutions aimed at facilitating service and working with clients. It is worth noting here that an attractively priced and timely offer is only part of the process. Leaseholders, when looking for the right terms for themselves, often expect an equally comprehensive, fast and hassle-free service once the contract has been concluded. This poses a challenge for the company to ensure that, at every stage of contract processing, everything is organised and performed right away. It turns out that properly structured systems for the insurance industry can be the key to success in such situations.

Insurance Policies Factory: Speed in the leasing industry

The hackneyed topic of the article hides many dependencies, the end result of which is efficiency and a measurable business effect. But does this have anything to do with insurance? It turns out it does. And quite a lot. Recent years have shown the scale and speed of development of the leasing market. And it is not only about the funds that are allocated to financing the leased items. Companies systematically supplement their offer with additional products, preparing entire packages of services supplementing financing proposals for their clients. For many companies, it is a significant source of income.

MultirRIA turns 10 years old

This year marks the 10th anniversary of the product implementation at PKO Agencja Ubezpieczeniowa and PKO Leasing (then Raiffeisen Insurance Agency and Raiffeisen Leasing Polska SA): a system for sales and comprehensive policy service.

Insurance policies factory: A technological step forward

For a distributor of insurance products, the use of their own IT system means primarily the ability to offer customers products from many companies, without the need to log into portals created by specific companies. In addition to the comfort of choice, which is undoubtedly extremely important for the customer, our own system significantly simplifies the distributor’s billing or reporting processes.

“VSoft does not work”, good communication practices in the helpdesk

For starters, I have some bad news for everyone. Software bugs do and will happen. Despite the fact that programmers are cordoned off by testers, and applications are scanned with automatic tests from A to Z, it can always happen that a mouse slips through. As history shows, sometimes it is a whole horde of mice, which was experienced by Cyberpunk 2077 users not so long ago. Sometimes it is one, fat and extremely expensive mouse. I mean the case of the NASA Mars Climate Orbiter probe, which in 1999, as a result of a rather prosaic error – inconsistency of the units used in the flight trajectory calculation – was destroyed in the Martian atmosphere. Almost 330 million dollars evaporated along with the probe, which is how...

Insurance policies factory: How to achieve operational efficiency in the insurance area

Thousands of customers, thousands of cars, thousands of policies and the same repetitive processes: offering, insurance, administration. And this is only a small part of the daily work performed by the Insurance Department in a leasing company. Complicated processes of insurance portfolio management in leasing companies require continuous and full involvement of employees, and there are times when you simply end up shorthanded.

Data exchange standard for insurance

Standardization is a process that facilitates and improves many areas of our lives. How much more convenient it is to have one (instead of several different) charger with a micro-USB port that we can use to charge the phone, wireless headphones or an e-book reader. On a daily basis, we do not pay attention to how valuable it is to have such amenities until they become an irreplaceable rescue in the least expected situation.

The process of choosing the solution which handles the insurance processes

“Oh, what a beautiful Monday morning! The leaves turn golden and red in the rays of the autumn sun… What shall I do today? Or maybe one could implement an insurance handling system?” – Oh! Wait! It doesn’t work like that! Let me re-say this: “For three months now, I have been hearing employees complaining that the current IT system is old and works slowly. I’ll buy them a new one, oh, this blue one – so pretty, they’ll be happy”- oh no, no, that’s not the way! Another case scenario: “In the last six months, the costs of one department have been increasing constantly, something is not going well there. I will implement a system tomorrow, as the situation will certainly normalize”- if you really think so,...

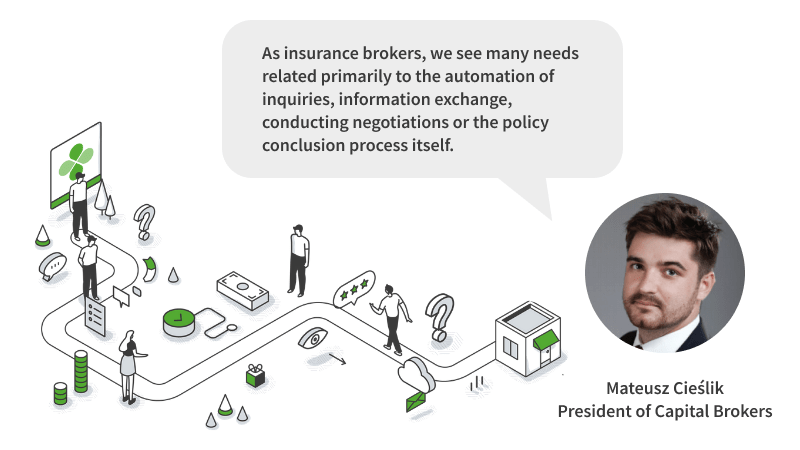

Technological future of brokers – interview with Mateusz Cieślik, President of Capital Brokers

The selection of a solution on which the daily work of the team will be based requires a good analysis and drawing plans for further development. Providers of brokerage systems should update the tool based both on the needs resulting from market changes as well as individual customer needs. Brokers are looking for solutions that will delight them with a widely developed menu bar, personalization and ensuring cooperation in development. The Krakow-based brokerage firm Capital Brokers Insurance Group has been using VSoft SA services for four years. We talk to Mateusz Cieślik, President of the Management Board of Capital Brokers, about how the VSoft Insurance Broker solution supports the work of the law firm.