VSoft Insurance Platform – a solution for selling insurance products and managing a policy portfolio

5

15

+350 000

policies issued in the leasing and dealer channel

+3 000 000

insurance proposals prepared annually

Advantages of implementing VSoft Insurance Platform

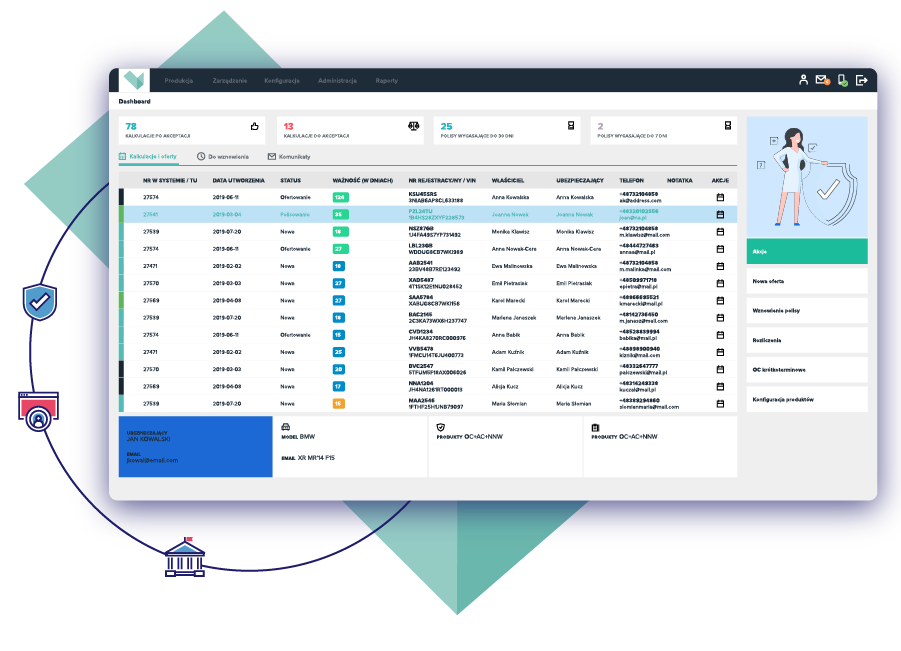

VSoft Insurance Platform is a dedicated solution for the insurance industry. It enables the complete handling of insurance processes. From offer preparation, through policy issuance and post-sales service, to the settlement of premiums and commissions — all within one integrated system.

The solution supports daily customer service. It covers the entire process – from the analysis of needs to signing the contract.

The system provides full support for post-sales processes, such as policy updates, withdrawals or settlement of premiums and commissions. In addition, it allows ongoing monitoring of sales and provides a database of information about customers, their insurance items and policies.

It operates in an offer comparison engine mode, allowing the sales of several products in a single process. This allows management of the proposed insurance coverage and the availability of insurance products in the sales network.

Additional advantages of implementing include:

- integration of all processes related to the handling of insurance products in a single system,

- increase in the efficiency of insurance product sales,

- automation of billing and reporting processes,

- the possibility of implementing the product as a tariff engine.

Dynamic and flat (offline) tariffs of selected Insurance Companies

Easy definition of insurance products

Modules available in the solution:

Product engine

Sales

CRM

Post-sales service and administration of policies

Full systemic support at every stage of the life of an insurance product.

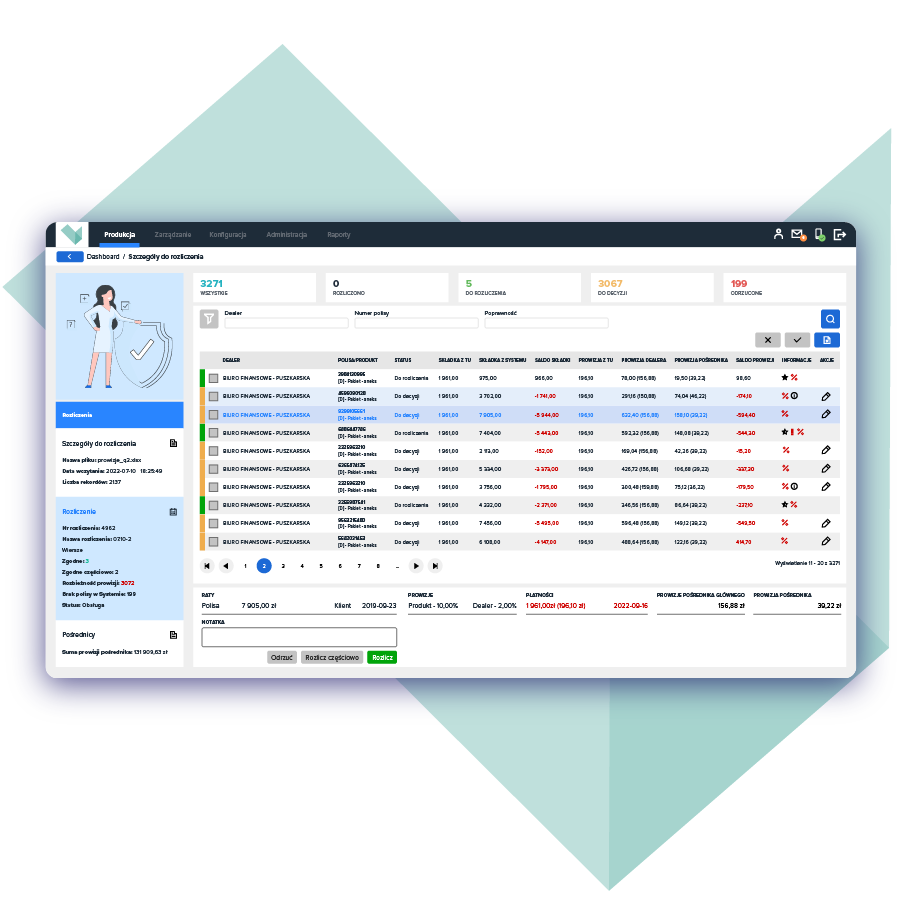

Settlements

Reporting and analytics

Comparison of insurance offers and options

Management of document templates

Integration and API

VSoft Insurance Platform in practice

Effective sales of insurance products

VSoft Insurance Platform is a solution for insurance agencies that want to provide their clients with individually tailored insurance coverage.

A significant functionality of the system is the comparison of offers and insurance coverages, which supports the active sale of both basic and additional products that meet the customer’s needs.

We have also ensured the increased efficiency of handling key business processes and supporting up-selling and cross-selling activities. This is possible through:

- automatic communication with the systems of Insurance Companies,

- the possibility of including in the basic offer any additional products offered by the agency,

- cyclical mechanisms to ensure continuity and bulk generation of offers and renewal contracts.

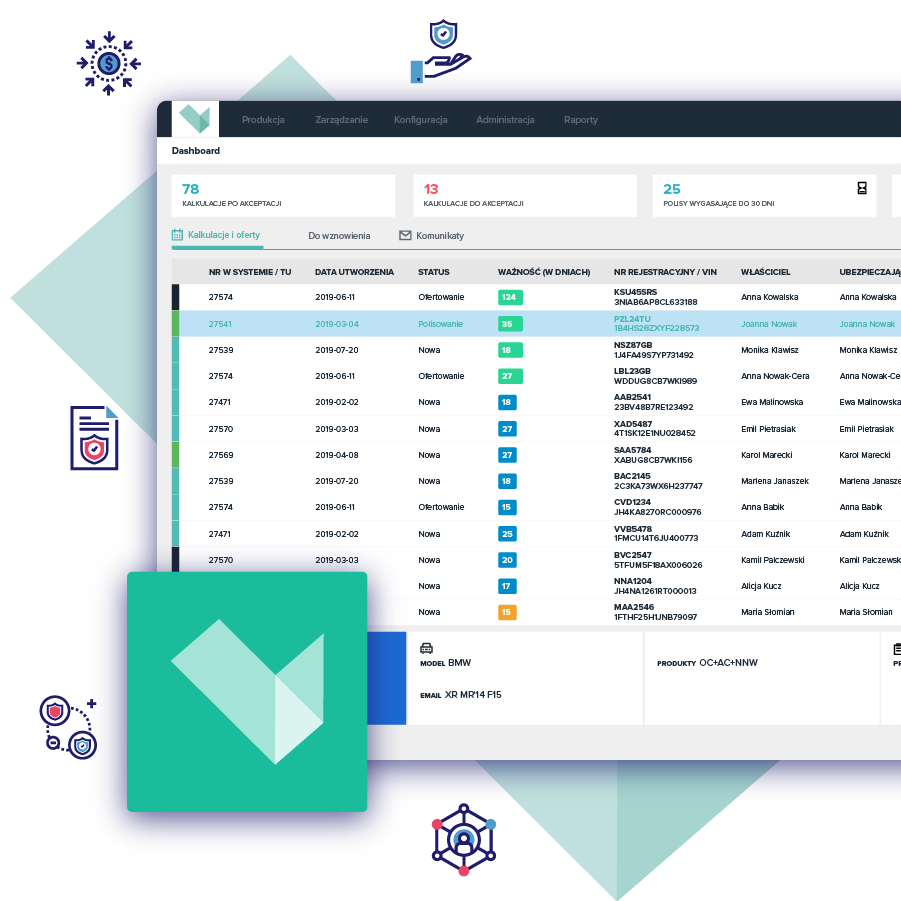

Flexible introduction of new versions of insurance products into the offer

The system ensures the shortest possible time for defining and updating insurance products available in the system. Express time to market is one of the key capabilities of VIP.

The calculation of the offer is based on insurance tariffs that have already been customised or are ready and available in the system. These are both online and offline tariffs. This allows any version of the product to be launched, just by configuring a set of key parameters.

Additionally, the solution supports product versioning, so that product changes can be modelled well in advance.

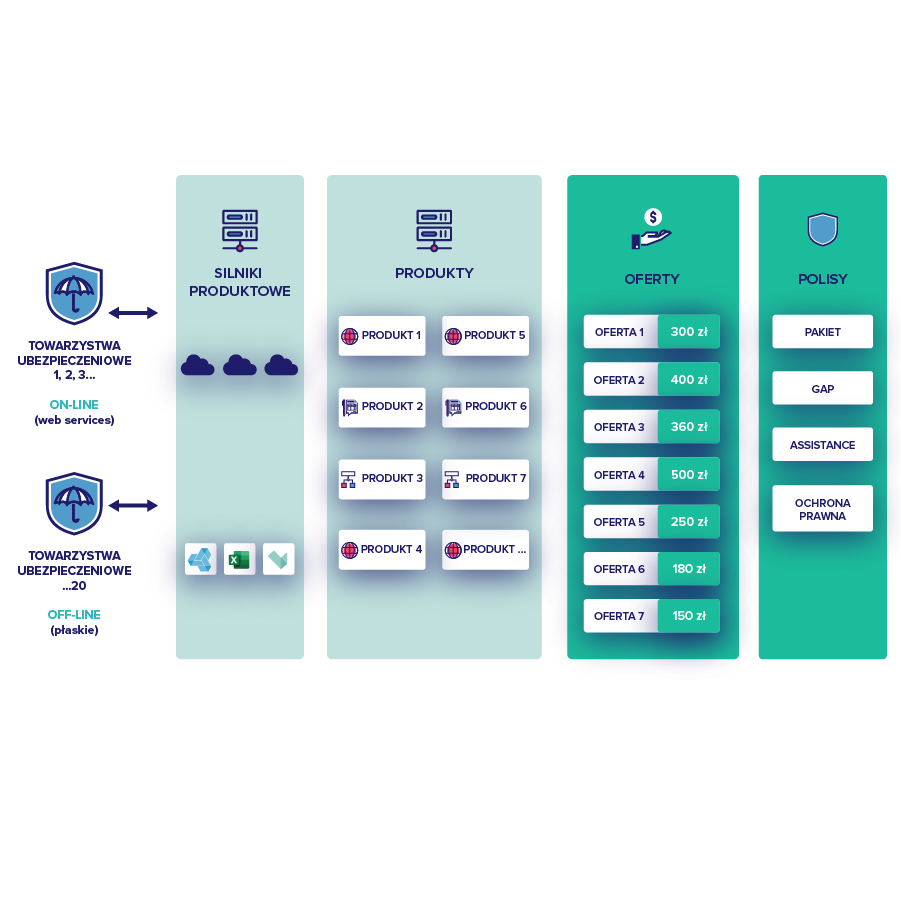

Dynamic tariffs at your fingertips

VSoft Insurance Platform is integrated with selected dynamic tariffs for motor products in the leasing and dealer channel.

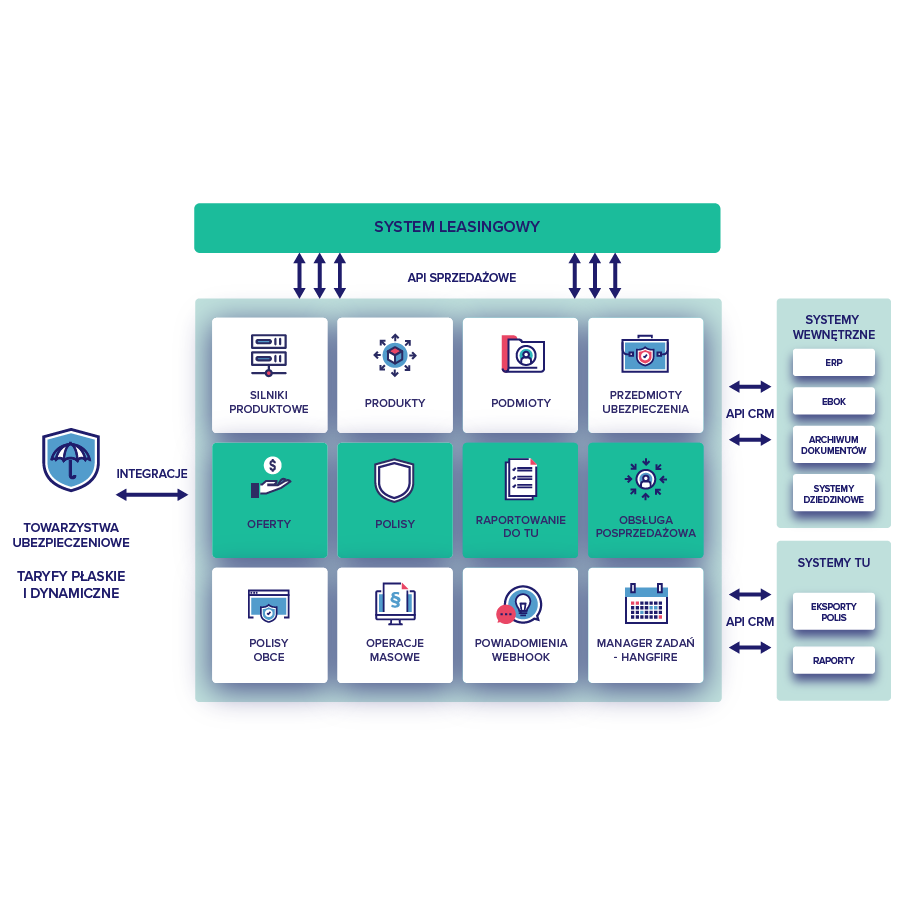

The system architecture allows for expansion with further integrations, enabling the use of dynamic tariffs of subsequent insurance companies. Sales and post-sales processes, depending on the Insurance Company, can be partially or fully implemented using online services.

We have also taken care of the possibility of creating and modifying tariffs in the offline model (so-called flat tariffs) by providing dedicated tools for this purpose.

Both tariff models can operate in parallel. This approach makes it possible to compare premiums and coverages for each type of tariff.

The APIs provided by the system allow the solution to be used as a product engine aggregating various tariff models. This way, the implementation of several dynamic or offline tariffs in an organisation only requires integration with VIP.

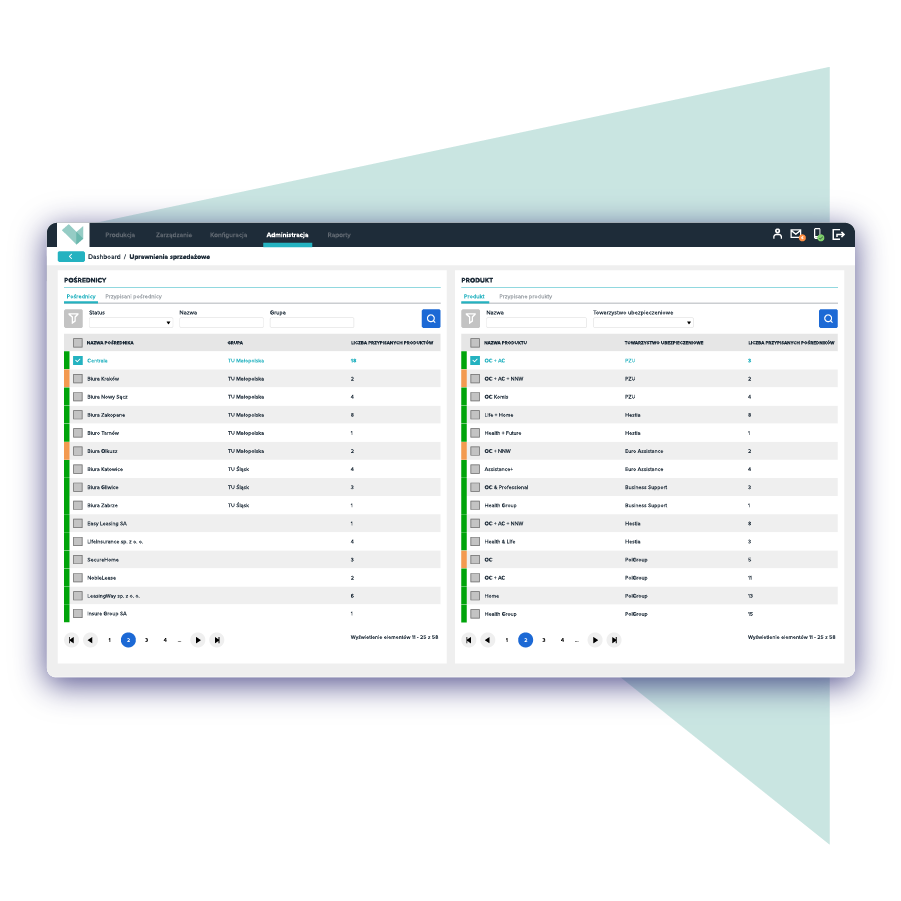

Management of a complex sales network

The platform’s modular design and advanced configuration features mean that reflecting a complex sales network in the system will not be a problem.

The solution easily configures commission levels, assigns product rights and manages changes to product offers. Besides, it is possible to manage the discount budget and monitor the funds allocated for customer discounts.

Additionally, the automation of the settlement process eliminates manual, repetitive work, significantly reducing time and service costs.

Easy integration with the existing IT ecosystem

VSoft Insurance Platform provides services that enable the full sales process to be executed from an external system, such as a leasing system. In this way – most of the activities involved in preparing an offer can take place outside the insurance system, without having to modify existing processes in the organisation.

Apart from handling sales processes, VIP provides methods to enable the existing IT ecosystem to retrieve data to feed the databases of invoicing, leasing or reporting systems.

Additional materials

Case study

Process optimization through integration of key systems of a client from the leasing industry

The integration of a leasing client’s key systems has improved data flow, reduced the risk of errors and lowered operating costs. Read how the implementation influenced process optimisation and the results achieved.

Blog

Insurance Product Management

Discover the secrets of insurance product management! Our latest blog post analyzes the evolution of tariffs, from traditional to dynamic, utilizing web services.

Learn how the VIP System revolutionizes processes, enabling flexible product management, sales network settlements, and the creation of personalized offers.

Blog

"About integrations, data processing and different products," writes Grzegorz Skulimowski, business solutions architect, VSoft.

Stay updated! On our LinkedIn profile, you will find the latest information about our products and, above all, a wealth of knowledge about the insurance industry.

We invite you to actively participate in discussions, share your insights, and delve into the intricacies of the industry. Together, we create a space where expertise meets innovation.

Write to us

We’d love to tell you more about the VSoft Insurance Platform! Complete the form and we will contact you and present the range of possible solutions.