VSoft Credit – a central system for banks and financial institutions to handle sales processes

2x

4x

>15

1

Process optimization is the key to business success

Through constant collaboration with the financial sector, we can quickly respond to evolving internal and external factors and tailor our solutions to its needs.

Advantages of implementing VSoft Credit

The primary benefit of implementing the system is an increase in sales of credit products while reducing the time required to process applications. With a faster process, the bank’s employees can focus on customer relations rather than operational or after-sales activities. Digitizing processes also reduces personnel costs.

The advantage of possessing the system is also acquiring a more accurate assessment of the customer and the transaction. Thanks to data from external systems, or, for instance, the possibility of implementing various credit risk assessment methodologies, the company has insight into the data and can monitor them within a single system.

Additional advantages of implementing the solution include:

- faster credit granting,

- reduction in target reserves and operational risks,

- shorter time of preparing the initial credit decision,

- increased quality of the credit portfolio,

- increased adequacy of credit risk assessment methods to given customer groups,

- elimination of the “paper” circulation of the credit file,

- automated use of information extracted from external interfaces,

- handling of multiple products within a single application,

- handling of activities related to the application, i.e., accounts, cards, electronic banking, etc.

Increase in the sales of credit products

Reduction in the costs of maintaining multiple systems

Continuous development and security

We have created VSoft Credit on the basis of our experience in the field of credit processes.

We know what measures will work for your company!

We’ll support you at every stage of credit process

Calculation, offer and application

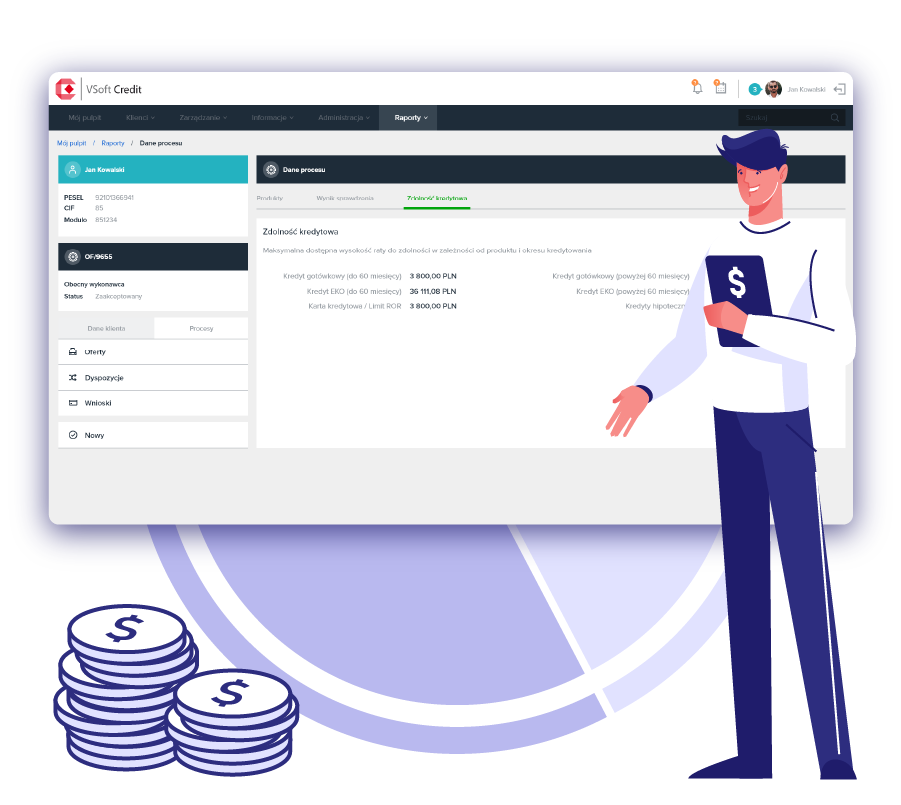

The system includes ready-to-use processes for preparing calculations for individual customers. All you need to do is ask the client a few questions and obtain the required consents, and the system will automatically estimate credit capacity and pre-scoring. It will also adjust the loan parameters to match these indicators. Data can come from other sources, such as a central system, a frontend application, or a website where the client submitted their application details.

Assessment and decision

VSoft Credit’s built-in decision engine enables automatic credit decisions. These terms are directly transferred to the documents for signing and fund release. The decision module can use data from the registration module or other sources.

Agreement and launch

The product agreement is generated using a customized document template, tailored to parameters chosen by the system or advisor to meet the client’s needs and application details. It can be delivered through both branch and digital channels. Fund disbursement can be fully automated or managed via system roles.

Reports

We provide reports easily and conveniently — as data feeds for BI tools, ready-to-download reports from forms, or visual data dashboards from the CRM that staff can view on-screen. We also assist with data analysis and report preparation for compliance and audit purposes.

Supporting processes

All post-sales activities ordered by the customer and those carried out between structures at the customer’s site can have document templates sewn in to generate, as well as share data with, for example, robots in the organization and control them.

Administration and configuration

Processes can be managed internally within the organization. We offer modern tools for designing processes, processing data, creating document templates, and defining data validation rules — all without the need to deploy a new system version.

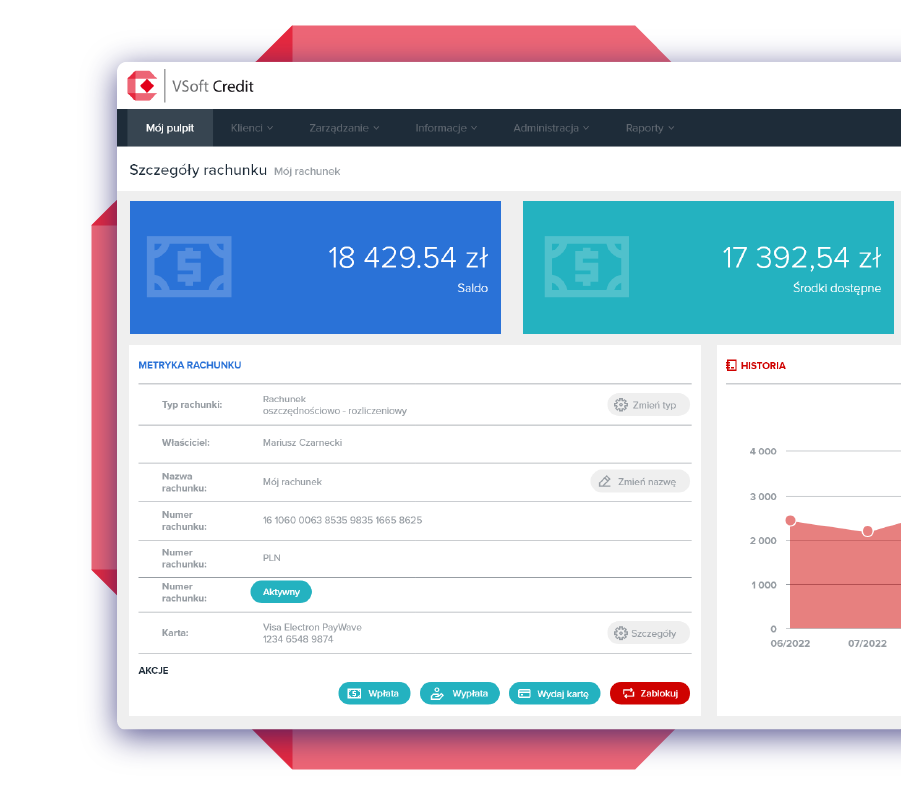

The application of VSoft Credit

Banks

The VSoft Credit platform is the ideal solution for managing credit processes in bank branches (branches, business centers, virtual branches, service points, agencies).

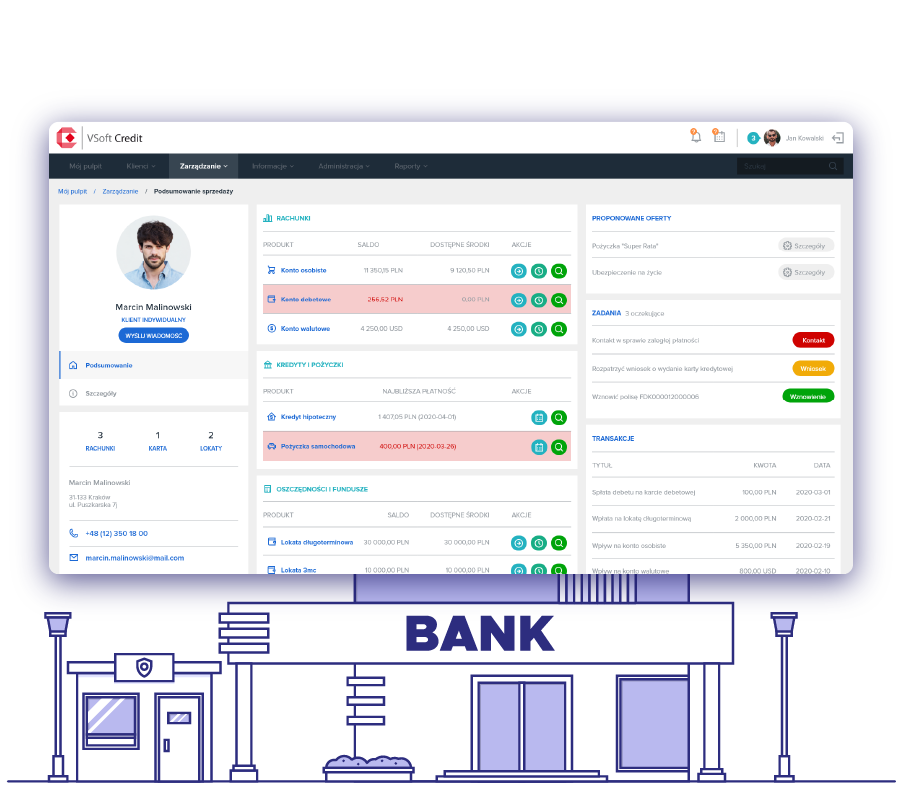

It offers a complete 360° customer view, providing employees with all the necessary information in one place — including product details, balances, offers, cooperation history, and customer profitability.

Thanks to its efficient process engine, the task list is presented in a clear, user-friendly format. The view includes:

- necessary data about the executed process,

- currently assigned processes,

- case categories,

- SLA alerts about upcoming activity deadlines.

Handling sales opportunities and mobile banking

The system includes an e-credit application process in which the client enters all the data needed for credit assessment and attaches the required documents.

VSoft Credit integrates seamlessly with your online banking system. This enables handling loan applications or applying for products based on pre-approved credit limits.

Additional materials

Article

Rating assessment of transactions

Article

Credit systems and central systems in banks

Article

Credit Process Management System for Corporate Clients

In one of our projects for a major banking institution, we were tasked with designing a solution to support the entire credit process in all its complexity—from the initial offer to the disbursement of funds—for various types of corporate clients and decision-making paths.

Article

Modern online processes in banking based on the workflow system

The workflow system is a tool that organizes, monitors, and automates task sequences within a defined process. In the context of online banking, this means that every stage of a transaction or financial operation can be precisely controlled and tracked.

Write to us

Are you interested in a solution for automating credit processes?

We’d love to tell you more about the VSoft Credit system! Complete the form and we will contact you and present the range of possible solutions.