VSoft Tax Reporting – a platform supporting mass settlement of all types of tax returns

A tool that automates the reporting process as well as reliable, timely and error-free settlements with control institutions.

What are the reasons for using the VSoft Tax Reporting platform?

>50

ready-made document templates

21

categories of handled taxes

>200 000

tax returns sent per year

If, during sensitive periods, completing a large number of reporting documents hamstrings the work of the team responsible for tax returns, this is a clear signal that it is worth considering the implementation of dedicated software.

When is it worth considering implementation of a tax reporting system?

Meeting all the requirements of the tax authorities and financial control is not an easy task. The lack of appropriate tools hinders a proper settlement and generates unnecessary expenses.

This applies to the majority of companies, where returns are completed manually, whether for individual purposes or for external customers. Then, the use of the VSoft Tax Reporting platform offers significant benefits, primarily by saving the time of experts dealing with taxes in the company.

Key advantages of the VSoft Tax Reporting platform

The platform significantly streamlines the process of completing returns and other reporting documents, as well as helps to optimise the costs associated with taxing an organisation’s income and property.

Automatic prompts and a variety of other mechanisms are responsible for correct and timely settlements. Annual updates include changes to regulations and new return templates, guaranteeing the compliance of operations with current tax law. The system provides a complete and secure repository for data and reporting documents, ensuring audit readiness.

Bulk generation and sending of returns and reports

Standardisation and automation of the reporting process

Correct and timely settlements

Minimising operation costs

Saving your experts’ time

Secure data storage and processing

Find out how we can provide your business with peace of mind during the tax return period

Support at every stage of the tax and financial reporting process

Getting data from internal and external systems

Data can be entered using batch files, via a web interface, by means of batch processing or a selected electronic data exchange interface.

Integrating and validating data

The system ensures the accuracy of the data entered, their delivery to the addressee and correct handling on the part of the Ministry of Finance. Using external services, it enables validation of counterparty data.

Preparing tax returns and handling corrections

The platform has mechanisms that secure the timely filing of all required tax documents and the management of corrections in the form of individual returns or whole packages.

Handling of electronic returns and print packages

VSoft Tax Reporting handles all the file formats required to electronically send tax returns to tax offices, the Ministry of Finance, taxpayers as well as printing houses.

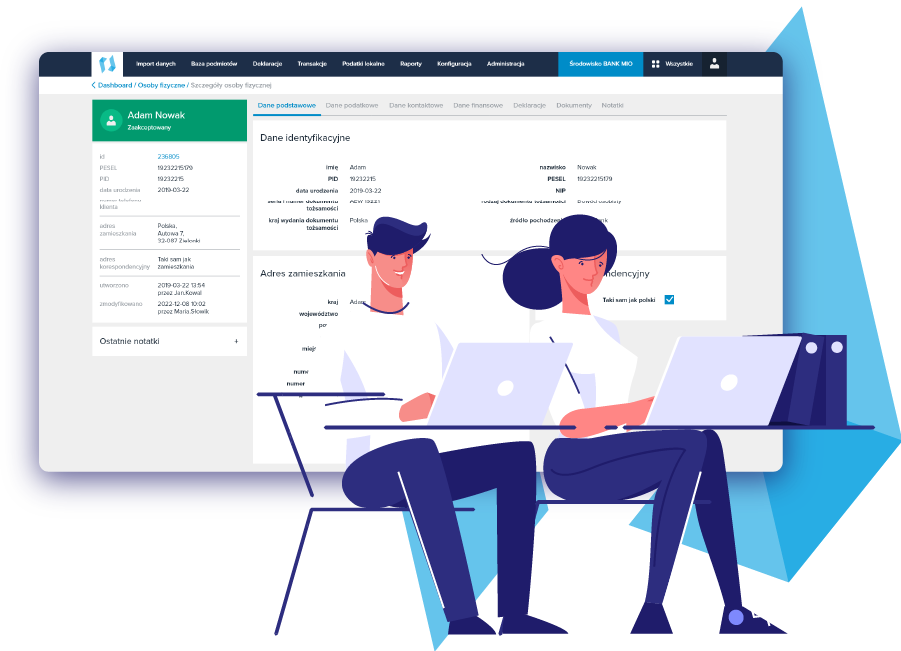

Maintaining a database of natural and legal entities

Dedicated 360° views facilitate the use of entity information. All data of natural and legal persons are collected in one place along with additional documentation.

Applications of VSoft Tax Reporting

Types of reports and statements handled

See what types of reporting and returns our system will handle for you!

The system provides full service of tax statements and returns in the following fields:

- flat-rate PIT and CIT,

- personal income tax liabilities, including information on the earned income and capital revenue

- identification, registration and update notifications as well as proxies,

- income of tax non-residents,

- settlement of ZUS (Social Insurance Company), PFRON (State Fund for Rehabilitation of Disabled Persons) and NFZ (National Health Fund),

- local taxes

Dodatkowe materiały

Materiał produktowy

Sprawozdawczość podatkowa i finansowa

Pobierz ulotkę i dowiedz się, co robimy w zakresie sprawozdawczości oraz jakie wsparcie oferujemy na kolejnych etapach realizacji tego procesu w ramach platformy VSoft Tax Reporting.

Artykuł

Automatyzacja procesu rozliczeń podatkowych na podatek od nieruchomości, rolny oraz leśny

Nasz ekspert w obszarze sprawozdawczości podatkowej Grzegorz Sroka przedstawia, jakie wymagania powinien spełnić system do automatyzacji rozliczeń podatków lokalnych.

Webinar

Wszystkie podatki lokalne w jednym systemie

Podczas webinar przeszliśmy przez najważniejsze funkcjonalności systemu VSoft RET i pokazaliśmy jak w praktyce wygląda automatyczne wyliczenie zobowiązań i wytworzenie deklaracji.

Podcast

Zeznań co nie miara... Jak automatyzować sprawozdawczość w instytucjach finansowych?

Czy można mówić ciekawie o podatkach? Dla Grzegorza Sroki, który w VSoft specjalizuje się w obszarze sprawozdawczości to naturalne. Rozmowę z cyklu DLT prowadził Łukasz Piechowiak.

Write to us

Are you interested in a platform supporting mass settlement of all tax returns?

We’d love to tell you more about VSoft Tax Reporting! Complete the form and we will contact you and present the range of possible solutions.

We’d love to tell you more about VSoft Tax Reporting! Complete the form and we will contact you and present the range of possible solutions.