VSoft Credit – a central system for banks and financial institutions to handle sales processes

2x

4x

>15

1

Optimization of banking processes is the key to business success

Advantages of implementing VSoft Credit

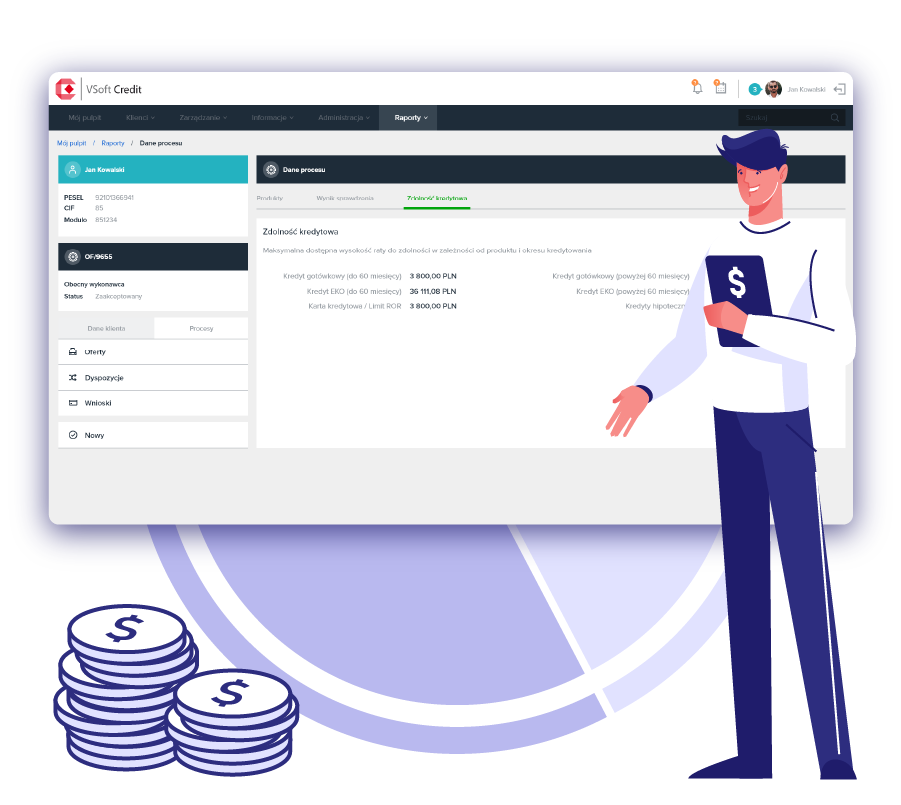

The primary benefit of implementing the system is an increase in sales of credit products while reducing the time required to process applications. With a faster process, the bank’s employees can focus on customer relations rather than operational or after-sales activities. Digitizing processes also reduces personnel costs.

The advantage of possessing the system is also acquiring a more accurate assessment of the customer and the transaction. Thanks to data from external systems, or, for instance, the possibility of implementing various credit risk assessment methodologies, the company has insight into the data and can monitor them within a single system.

Additional advantages of implementing the solution include:

- faster credit granting,

- reduction in target reserves and operational risks,

- shorter time of preparing the initial credit decision,

- increased quality of the credit portfolio,

- increased adequacy of credit risk assessment methods to given customer groups,

- elimination of the “paper” circulation of the credit file,

- automated use of information extracted from external interfaces,

- handling of multiple products within a single application,

- handling of activities related to the application, i.e., accounts, cards, electronic banking, etc.

Increase in the sales of credit products

Reduction in the costs of maintaining multiple systems

Continuous development and security

We have created VSoft Credit on the basis of our experience in the field of credit processes.

We know what measures will work for your company!

Support at all stages of credit processing

Calculation, offer and application

Assessment and decision

Agreement and launch

Reports

Supporting processes

Administration and configuration

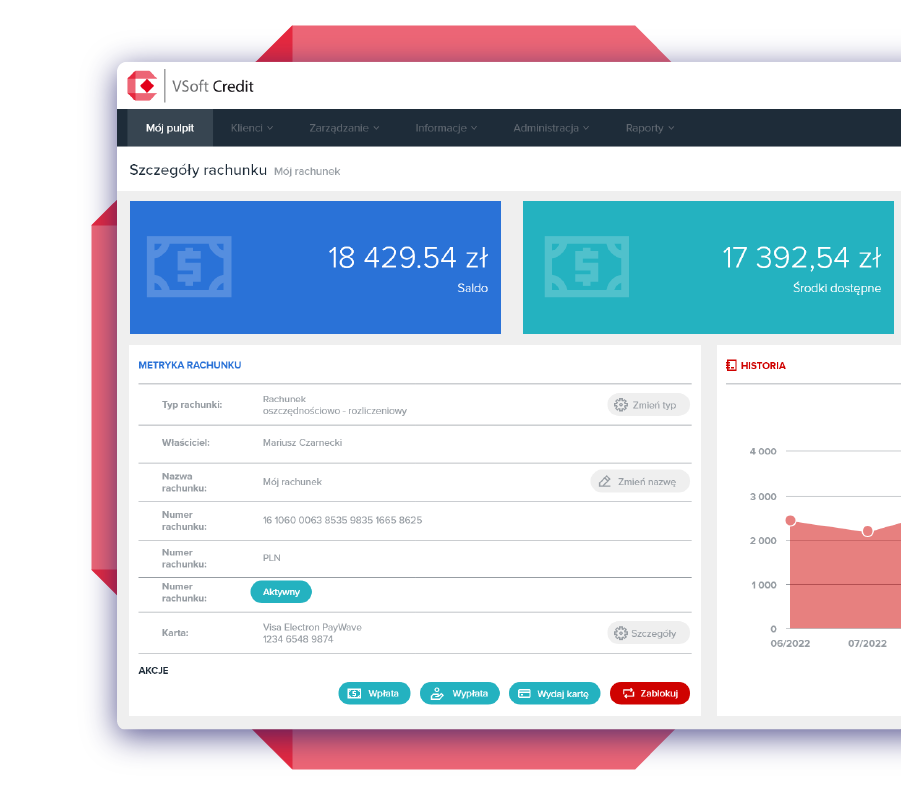

The application of VSoft Credit

Banks

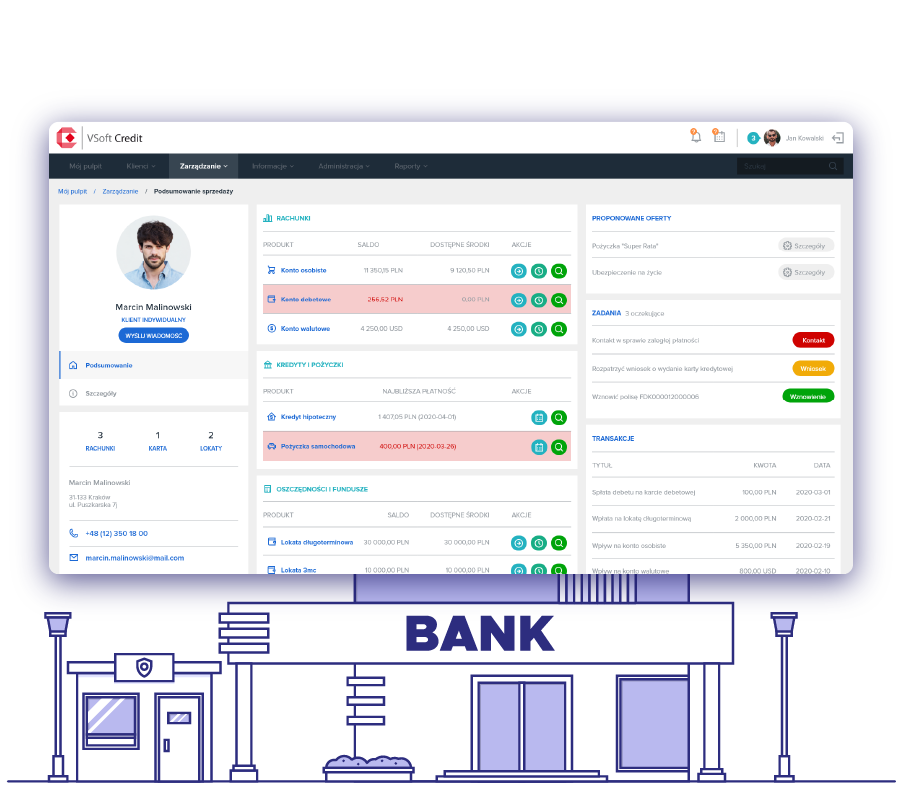

The VSoft Credit platform is a perfect solution for handling credit processes by bank facilities (branches, business centers, virtual branches, service points, agencies).

It has a built-in 360° view of the customer, so the sales employee has comprehensive information about the customer, such as: their products, balances, prepared offers, history of cooperation with the institution and profitability.

Thanks to a powerful process engine, the list of cases to be handled is presented in a clear formula. The view shows:

- necessary data about the executed process,

- currently assigned processes,

- case categories,

- SLA alerts about upcoming activity deadlines.

Handling sales opportunities and mobile banking

The solution also features the process of credit e-application, during which the customer completes a set of information required to assess creditworthiness and reliability and attaches the necessary documents.

VSoft Credit will seamlessly integrate with your online banking system. This makes it possible to handle a credit application or apply for products based on predetermined credit limits.

Additional materials

Article

Rating assessment of transactions

Article

Credit systems and central systems in banks

Article

A fast and secure loan process requires advanced tools.

Article

Modern online processes in banking based on the workflow system

The workflow system is a tool that organizes, monitors, and automates task sequences within a defined process. In the context of online banking, this means that every stage of a transaction or financial operation can be precisely controlled and tracked.

Write to us

Are you interested in a solution for automating credit processes?

We’d love to tell you more about the VSoft Credit system! Complete the form and we will contact you and present the range of possible solutions.